Car depreciation calculator tax

06042016 Savings Paid Tax Free From Today Banks and Building Societies to no longer deduct tax on interest on statements. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

They are paying ONLY for the initial depreciation and not for the cars full value.

. But what the car dealer wont tell you is that your shiny new car will lose 60 of its valuewhat we call car depreciationwithin the first five years. 2022 Honda N-Van Turbo Style Fun Honda S. Car Depreciation Calculator new.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. D P - A. Use the car lease calculator to estimate your monthly car payments when leasing a new car.

06042016 Savings Paid Tax Free From Today Banks and Building Societies to no longer deduct tax on interest on statements. You can then calculate the depreciation at any stage of your ownership. You can then calculate the depreciation at any stage of your ownership.

Getting to Car Marts. Depreciation is simply the wear-and-tear cost which reduces the value of your car after a few years. They are driven very little and are well maintained.

After paying income taxes on a 53924 salary the take-home pay is reduced to 43422. Lets assume you were looking to buy a three-year-old car for 12000. Find car models by depreciation using the search bar above.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. Current Redmond Auto Loan Rates. A P 1 - R100 n.

The average used car price has surged close to 30 in recent years bringing the average transaction to 27633. Calculate the cost of owning a car new or used vehicle over the next 5 years. Leasing a car has more variables.

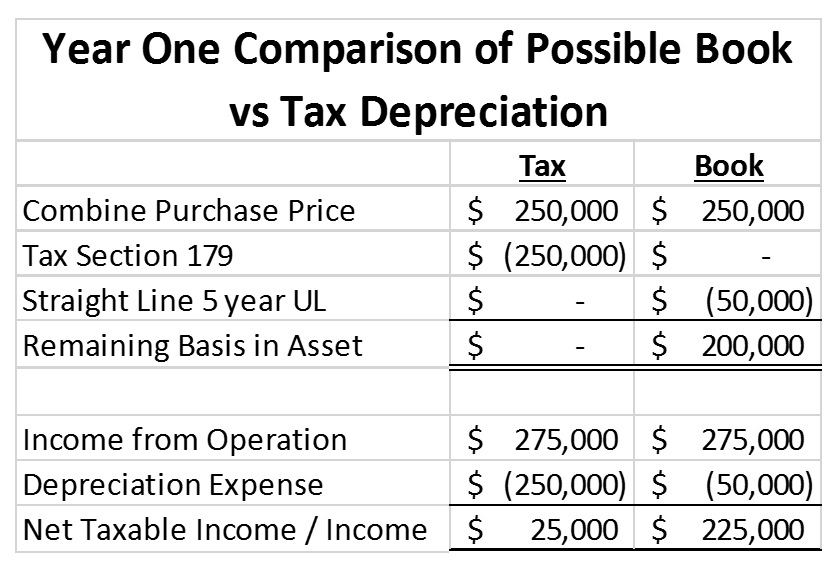

Accelerating depreciation with bonus depreciation Ushered in with the Tax Cuts and Jobs Act bonus depreciation makes it possible to claim 100 of the cost of any machinery and equipment purchased. For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty transmission. Group depreciation method Composite depreciation method Tax depreciation Capital allowances Tax lives and.

With zero depreciation coverage the insured does not have to pay the depreciation value of the damaged or replaced parts and the policyholder can claim the full amount. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. We publish current Redmond auto loan rates for new used vehicles.

The average car depreciation rate is 14. Edmunds True Cost to Own TCO takes depreciation. A program car is a one that was driven on company business by a manufacturer employee.

Water Intake Calculator new. An average car depreciates about 65 percent at the end of five years. In 2022 the average new car price exceeded 47000 and the median salary is 53924 for a full-time worker.

Downpay Trade-in less owed on Trade-in. Something called a program car is usually an exceptional bargain. The depreciation rate for each car varies.

Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Car Sale Roadshows.

It is important to know the depreciation cost of your car since this is an important factor if you want to sell your car after a few. Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as. You can now compare it to the price of a brand new car.

The second method is estimating the initial value of the car. Our car depreciation calculator helps you to calculate how much your car will be worth after a number of years. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make.

The Car Depreciation Calculator uses the following formulae. Car Loan Factors Explained. To use the calculators depreciation formula on line 10 enter the total price you paid for your new or used vehicle including sales tax.

This calculator for a car depreciation is also estimated the first year and the total vehicle depreciation. They usually have 10000 miles or less on the odometer. If you input the value into the 3 years box the car depreciation calculator will display the cars initial value in this case over 20500.

It applies to vehicles that are less than 5 years old and the policyholder can avail of it. Now heres the equation to calculate the monthly tax amount. That means if you bought a car for 32000 when youre done paying it off almost six years later youd have paid about 36000 for a car thats now worth maybe 13000.

Zero Depreciation Car Insurance. Loan interest taxes fees fuel maintenance and repairs into. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Finding out how much money it will cost to lease a new car truck or SUV is quick and easy with our lease calculator. Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model.

You can then calculate the depreciation at any stage of your ownership. These estimates do not include tax registration fees lien fees or any other fees that may be imposed by a governmental agency in connection with the sale and financing of the vehicle. Unfortunately the same auto limits that apply to Section 179 also apply to bonus the max deduction is 18200 in the first year.

Zero depreciation cover is also known as bumper to bumper or nil depreciation cover. 06042016 Savings Paid Tax Free From Today Banks and Building Societies to no longer deduct tax on interest on statements. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments helps you figure out how expensive of a car you can afford to buy given a set monthly budget.

Use our company car tax calculator to help you understand the tax benefit in kind charges running costs insurance group of the car you are interested in. Monthly depreciation monthly interest tax rate monthly tax amount 22222 7980 00725 2190. On the other hand if you want to use Kelly Blue Book see the instructions that appear at the end of this post Line 11.

Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. Dealers pay low prices for them and are not shy to advertise them. Get accurate lease payment information with TrueCar.

Pin On Insurances

Free Macrs Depreciation Calculator For Excel

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

1

1

1

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

1

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators

Depreciation Of Vehicles Atotaxrates Info

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop B Tax Deductions Free Business Card Templates Music Business Cards

Depreciation What It Is And How To Use It Cropwatch University Of Nebraska Lincoln

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions