Payroll calculator for hourly employees

Ad The 1 Employee Scheduling For Shift Managers. Hourly Paycheck Calculator Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees.

Paycheck Calculator Take Home Pay Calculator

If you have hourly employees you know just how difficult it can be to manage their hours and run payroll.

. 1 Calculate Total Hours Worked. If you arent currently using payroll software and have just a few hourly employees the free hourly paycheck calculator below can help you determine how much to withhold from. The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions.

Simply enter their federal and state W-4 information as well as their. Next divide this number from the annual salary. Ad Get Started Today with 1 Month Free.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. The standard FUTA tax rate is 6 so your max. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To try it out enter the workers details in the. The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions.

To try it out enter the workers details in the. Free Unbiased Reviews Top Picks. Ad Join Other Business Owners Whove Made Their Payroll Management Easier.

Use Our Free Hourly Paycheck Calculator. The first step in the payroll hours calculating process is to add up the total hours an employee worked during your businesss pay period. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Calculator Use Use this calculator to add up your work week time sheet and calculate work hours for payroll. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours.

Read reviews on the premier Paycheck Tools in the industry. Ad Industry-Leading Security World Class Support To Transform Your Practice. Using The Hourly Wage Tax Calculator.

It will confirm the deductions you include on your. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

Ad Process Payroll Faster Easier With ADP Payroll. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. The primary difference between payroll for hourly and salaried employees is how you calculate those gross wages in the first place.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. All Services Backed by Tax Guarantee.

Fortunately you dont have to tackle. Efficiently manage end-to-end third party payroll processing without leaving Oracle HCM. View Gross-Up Payroll Calculator Calculate.

The math works a little differently for salaried employees hourly employees and contractors. Ad Manage your diverse payroll requirements with Oracle Global Payroll. Build Perfect Restaurant Schedules In A Few Clicks.

Ad See the Paycheck Tools your competitors are already using - Start Now. Gross wages for hourly employees. Youll need to multiply the number of hours your employee worked by their.

Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Payroll So Easy You Can Set It Up Run It Yourself.

Discover ADP Payroll Benefits Insurance Time Talent HR More. This online time clock uses a standard 12-hour work clock with am and pm or a 24. Ad Compare This Years Top 5 Free Payroll Software.

Important Note on Calculator. Get Your Quote Today with SurePayroll.

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Application Devpost

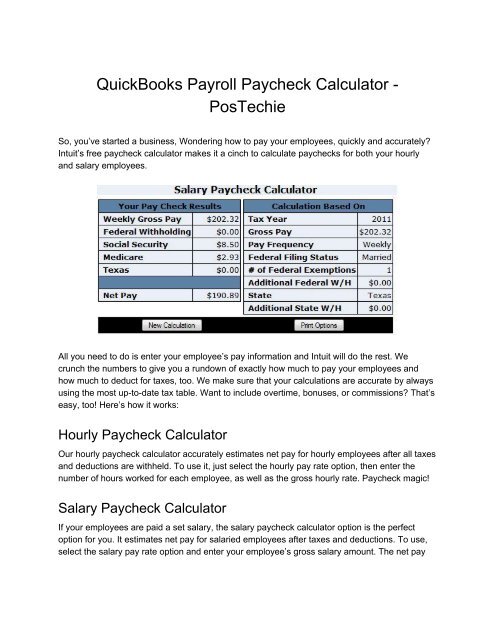

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

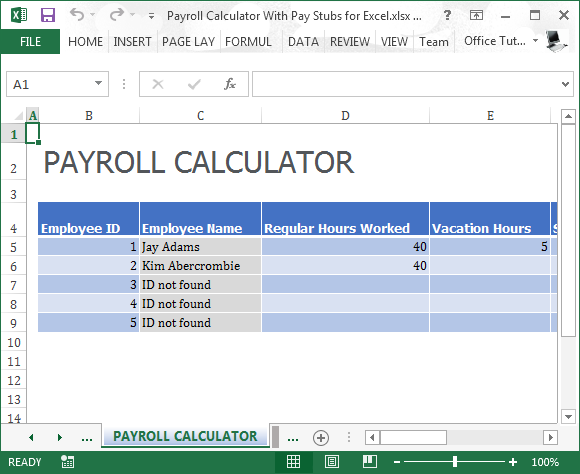

Payroll Calculator Free Employee Payroll Template For Excel

3 Ways To Calculate Your Hourly Rate Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Hourly To Salary What Is My Annual Income

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Calculator Application Devpost

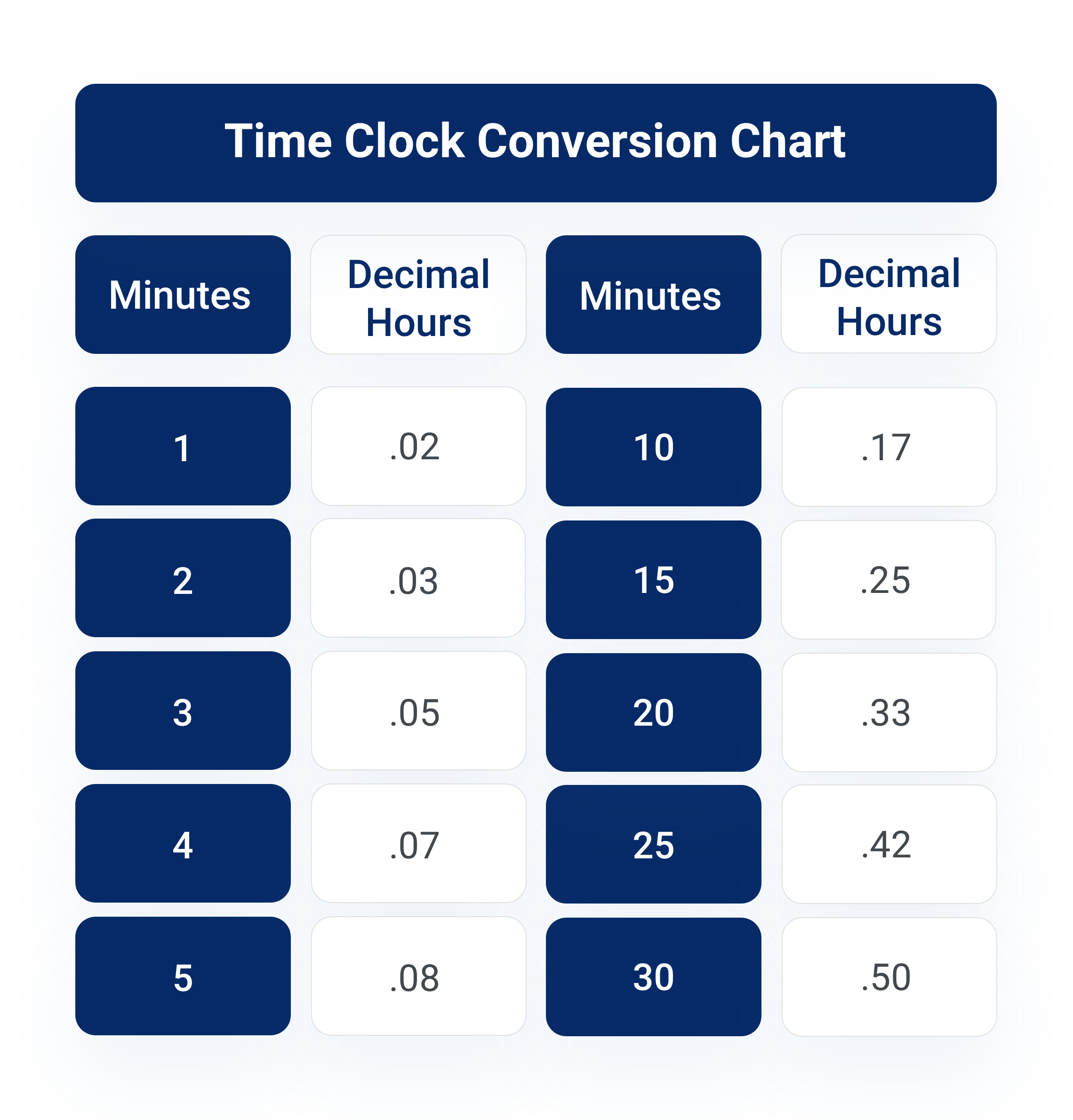

Time Clock Conversion Calculator For Payroll Hourly Inc

How To Calculate Payroll For Hourly Employees Sling

Forecast Payroll Calculations

Free Online Paycheck Calculator Calculate Take Home Pay 2022

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

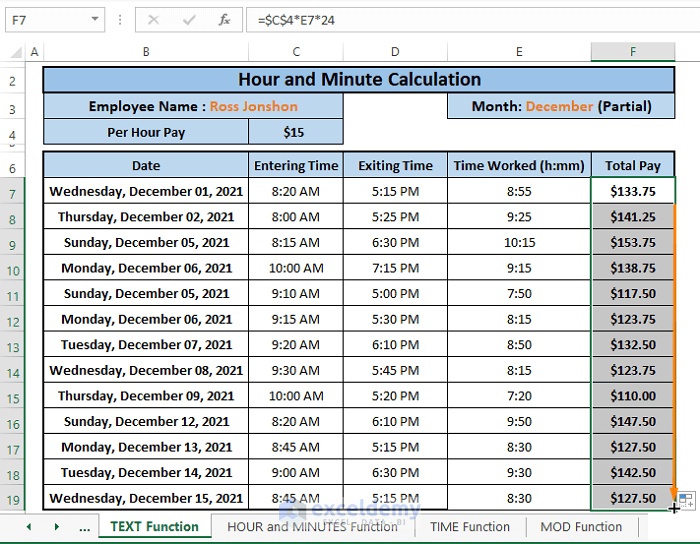

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways